A Little Skepticism Goes a Long Way

We recently received an email from a client requesting their current account balances. On the surface, this small request seems harmless, right? Well, the email continued with, “I’m currently taking care of an emergency and I’ll be checking my email for your response, please communicate via email.” Even though most hospitals do not condone cell phone usage, this email still didn’t feel right.

Rather than take any chances or completely ignore a request from a client we have served for over a decade, we decided to just call. Lo and behold, our client was not experiencing an emergency, did not have any need for his current account balances and just so happened to have had his email hijacked a day prior.

We have all heard about the scam email from an African Prince asking for $10,000 to get into the United States, which he will repay ten-fold because said Prince is supposedly worth 3 billion dollars. But this one was close to home, almost believable, and brilliantly began with one small request. Once they get you to send them the account balance, the next small request is for a few thousand dollars to pay for the “emergency” and so on.

At a boutique firm that services a small number of households, we are fortunate to become more than financial planners to our clients. We are able to develop relationships, learn more about our clients on both a personal and professional level, and serve as their chief financial officer. It also doesn’t hurt to know clients well enough to be skeptical of fishy emails.

This situation reminded us that there is no replacement for good old fashion communication. If face-to-face interaction isn’t practical, telephones and even emails are good tools in developing relationships. It is through time and numerous interactions that lasting relationships are created, and when involving one’s finances, these relationships and trust can mean everything.

GDP Forecasts a Mixed Blessing?

Although equity indices such as the S&P500 and NASDAQ have recovered tremendously since the 2008 recession, the United States GDP has not enjoyed such a robust recovery. This is not to say the GDP is not increasing and slowly getting back on track.

For the third quarter of 2013, Bloomberg estimated an increase in GDP of 2.0% annualized, which is certainly in the right direction, albeit a rather small increase. However, the most recent numbers from the government pegged the third quarter growth at 2.8% annualized, significantly ahead of Bloomberg’s estimate and even greater than last quarter’s increase of 2.5%.

Positive growth is good, beating expectations is good, so what could be wrong with these figures? Almost 30% of the GDP growth came from increases in private inventories. In a sense, this increase in inventory could be beneficial, potentially implying increased American manufacturing. This poses one potential issue: what happens if this increase in supply is not warmly greeted by an increase in demand? If we have stockpiles on hand, but not enough buyers interested in these products, we will likely experience a cutback in production. With inventories’ increasing influence on GDP growth, a cutback in production could detract significantly from fourth quarter growth and beyond. With personal consumption contributing more to GDP growth, our GDP heavily depends on innovation, production, and consumers who are willing to spend money.

Although the GDP growth figures were promising and better than projected for the third quarter, we must eagerly wait to see what happens in the final quarter of 2013. Will these stockpiles hinder future production or is the lack of demand we fear nothing but an excuse to doubt the positive GDP growth numbers? Only time will tell.

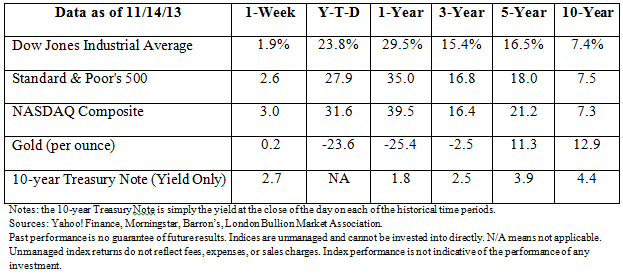

The Markets

This newsletter was prepared by Bourke Wealth Management.

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this e-mail with their e-mail address and we will ask for their permission to be added.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Gold represents the London afternoon gold price fix as reported by the London Bullion Market Association.

Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing.

Sources:

Barron’s (http://online.barrons.com/home-page)

Bloomberg (https://www.bloomberg.com/)

London Bullion Market Association (https://www.lbma.org.uk/)

Morningstar (http://www.morningstar.com/)

Horsesmouth (http://www.horsesmouth.com/ )

Wall Street Journal (http://online.wsj.com/home-page?mg=inert-wsj)

Yahoo! Finance (http://finance.yahoo.com/)