A Disappointing Black Friday…Weekend?

Although there has been much noise about adding Thanksgiving Day to Black Friday, creating a four day shopping extravaganza, the sales figures do not support the media attention.

Total sales actually fell 2.9% from last year. This does not necessarily foreshadow the demise of American consumerism. In fact, the National Retail Federation forecasts a 3.9% increase in Christmas season shopping compared to last year overall.

Cyber Monday, which is when online retailers discount many products substantially, saw sales jump 16% to $2.29 billion according to Adobe Systems. Total online sales for the four days beginning Black Friday and ending Cyber Monday, were up 26% compared to last year, coming in at $7.4 billion. These data suggest more and more shoppers are straying away from “Door Busters” and massive crowds, generally enjoying the same deals from the comfort of their own homes.

In case you have a hard time wrapping your head around the magnitude of these Black Friday sales figures, perhaps these National Retail Federation numbers can help put everything into perspective. 141 million people went shopping during the Black Friday weekend. With a total population around 350 million in the United States; that means over 40% of America went shopping. And although down $16.53 from last year, the average shopper spent $407.02 over the weekend. Over $177 of the $407 spent was purchased online, up 3% since 2012.

In summary, total sales down slightly, online sales up dramatically.

With another Black Friday behind us, perhaps we will continue the trend and purchase more online, avoid staying up into the wee hours of Friday morning, potential stampedes and hostile shoppers desperately vying for those Black Friday deals.

Big Banks Fined Billions on Interest Rate Manipulation

According to Reuters, Deutsche Bank, the Royal Bank of Scotland, JPMorgan Chase, Citigroup, France’s Societe Generale and UK-based brokerage RP Martin were all fined by the European Commission, the European Union’s executive branch. These banks were found to be rigging the London Interbank Offered Rate (LIBOR), colluding to profit from interest rate manipulation. The LIBOR serves as a benchmark for interest rates around the world and in varying fields, including mortgages, auto loans, student loans and even credit cards rates.

Deutsche Bank was fined 725 million euros, nearly $1 billion, receiving the bulk of the fines. Other involved banks include Barclays and HSBC, which avoided massive fines by notifying the Commission of the cartel’s existence.

For the first time, American banks JPMorgan Chase and Citigroup were fined for tampering with the LIBOR, though their fines were only $108 million and $95 million, respectively. Although $100 million is a massive sum of money, recall that last month JPMorgan Chase reached a settlement to pay $13 billion in fines for selling misleading and toxic mortgage-backed securities from 2005 to 2008.

Although fines continue to grow with the intent to dissuade banks from further manipulation, the EU’s competition commissioner Joaquin Almunia said in a statement, “This is not the end of the story.” He also emphasized that “We want to send a clear message that we are determined to find and punish these cartels.”

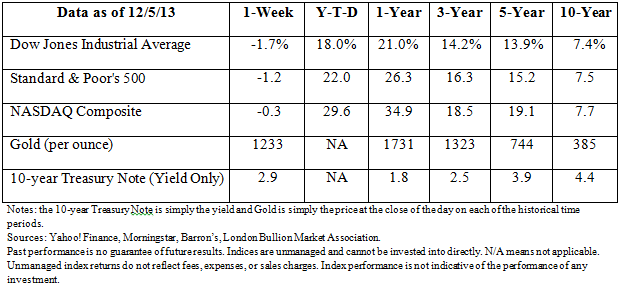

The Markets

This newsletter was prepared by Bourke Wealth Management.

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this e-mail with their e-mail address and we will ask for their permission to be added.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

Gold represents the London afternoon gold price fix as reported by the London Bullion Market Association.

Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing.

Sources:

Barron’s (http://online.barrons.com/home-page)

Bloomberg (https://www.bloomberg.com/)

London Bullion Market Association (https://www.lbma.org.uk/)

Morningstar (http://www.morningstar.com/)

Horsesmouth (http://www.horsesmouth.com/ )

Wall Street Journal (http://online.wsj.com/home-page?mg=inert-wsj)

Yahoo! Finance (http://finance.yahoo.com/)